County council vote to freeze Local Property Tax for two years amidst voter backlash fears

Cork County Council's executive pushed for a doubling of Local Property Tax because they say services including libraries and housing repairs will be hit hard by a €27 million budget deficit in 2023.

Cork County Councillors voted to freeze Local Property Tax at 7.5% until 2024 at last night’s council meeting, rather than to increase it to 15% as recommended by the council’s executive.

The vote came after the council’s Head of Finance, Lorraine Lynch, gave what councillors greeted as a “stark” presentation of the impacts of a projected €27 million budgetary deficit for the coming year.

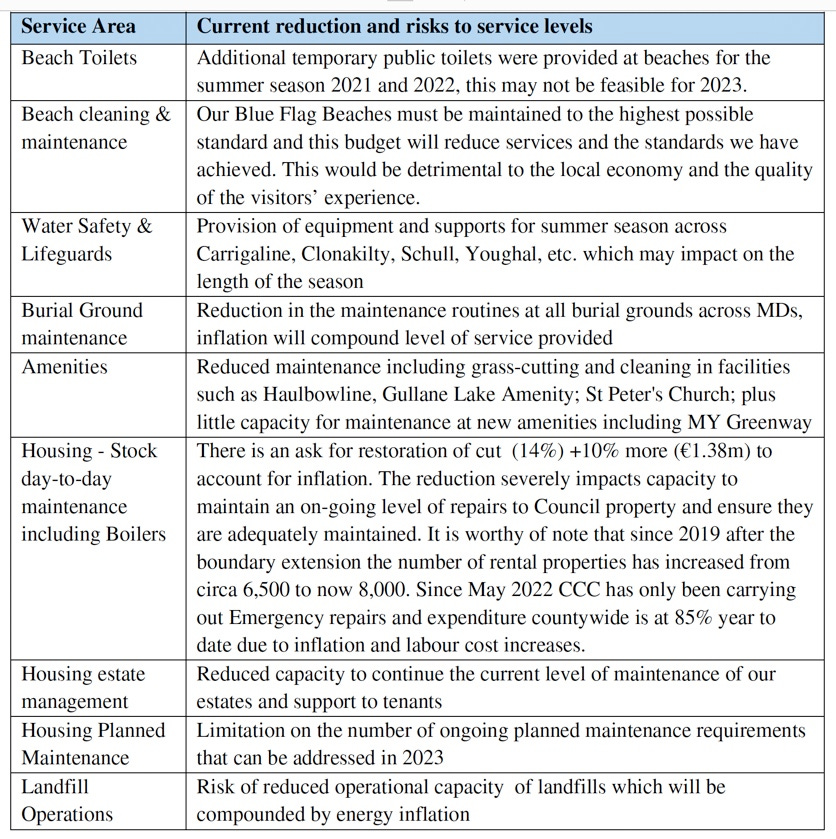

Sweeping service cuts

Ms Lynch told the council that sweeping cuts to services would include:

Repairs on council housing cut by €440,000

Housing Voids programme cut by €120,000

Library services cut by €375,000

Provision of recycling services cut by €670,000

Street cleaning services cut by €82,000

Maintenance of parks, pitches and playgrounds cut by €189,000

“Without additional funding going through there are more than likely going to have be cuts coming through,” Ms Lynch said. “We can look at increasing goods and services income from parking fines, recycling amenities and others.“

Factors including rising energy costs, which will cost the council an estimated €4.5 million in 2023, and inflation were blamed for some of the projected shortfall of €27 million.

However, of the actual funding gap of €16.8 million between the council’s projected income of €370 million and expenditure of €387 million, which has not factored in inflation and energy increases, the bulk of the funding gap actually comes from a pay increase for council staff.

€15.7 million council staff pay rise

Council staff are due a 6-7% pay increase of €15,717,761, in line with the national pay agreement.

The council wage bill is currently just under €162 million and will rise to €177.5 million in 2023.

Calls to double Local Property Tax

The council executive called for an increase in Local Property Tax (LPT) from 7.5% to 15%, with Lorraine Lynch pointing out that for the vast majority of houses, this would amount to no more than €23 per year.

“While no increase is palatable, neither is a severe reduction in services in the communities containing these homes,” the executive’s report stated.

LPT is an annual self-assessed tax which is applied to the market value of residential properties.

An increase from 7.5% to 15% in LPT for 2023 would have netted Cork County Council an additional €2.34 million of the €16.8 million funding gap.

County Mayor

However, Cork County Mayor Cllr Danny Collins said there was no appetite amongst elected representatives to go back to the people and ask for any kind of increase in the current climate.

“It’s frightening what Lorraine is showing us here today, but I can’t go back to the people and ask them for an increase,” Cllr Collins said. “People are being squeezed at the moment.”

Cllr Collins proposed keeping the rate the same and approaching central government to request additional funding.

This was initially seconded by Cllr Declan Hurley from West Cork Municipal District, who said, “under no circumstances can we increase the burden on households in the coming year. We will see tomorrow a record budget and for us in local government, increasing a charge on citizens in these times? There’s something very wrong about that. National Government will have to step up to the plate in terms of local authority funding.”

Cllr Hurley then further proposed that the council agree a two-year freeze at 7.5% into 2024.

This caused a significant amount of debate, with many councillors arguing that it was imprudent not to allow a review at the second year.

Cork County Council had until October 15 to decide which LPT rate to set and Cllr Alan O’Connor from Carrigtwohill proposed waiting until today’s budget announcement in the hopes that central government would announce more funding for local authorities as part of what is anticipated to be Ireland’s biggest budget ever.

One councillor pointed out that it would be “bordering on the absurd” for Fine Gael to be declaring a windfall budget while local representatives simultaneously voted to increase tax at a local level.

Many councillors made reference to discontent amongst the electorate.

In the ensuing vote, the proposal to keep the 7.5% LPT rate until 2024 was carried. Of 55 councillors, 34 voted in favour of the move, 22 against and one abstained.